Take Pictures Now

Mario Gonzalez - Wednesday, June 10, 2015

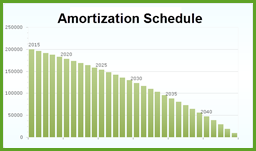

Preserve the memories you’re making by taking photographs of your home now. The pictures will remind you of the role your home played with your family and life. Reminiscing is easier when scrolling through pictures to remind you of people and times. One of the least heard r...